Financial Capital

At Tata Communications, we endeavour to optimally utilise our financial capital to generate maximum value for shareholders and other providers of capital. The allocation of our financial resources is supervised by our leadership team and the Board.

Our objective is to excel in our operations, while maintaining sustainability and strategically investing in critical and relevant resources to seize emerging opportunities. This approach ensures a robust business model, designed for perpetual growth.

Financial stability and liquidity management

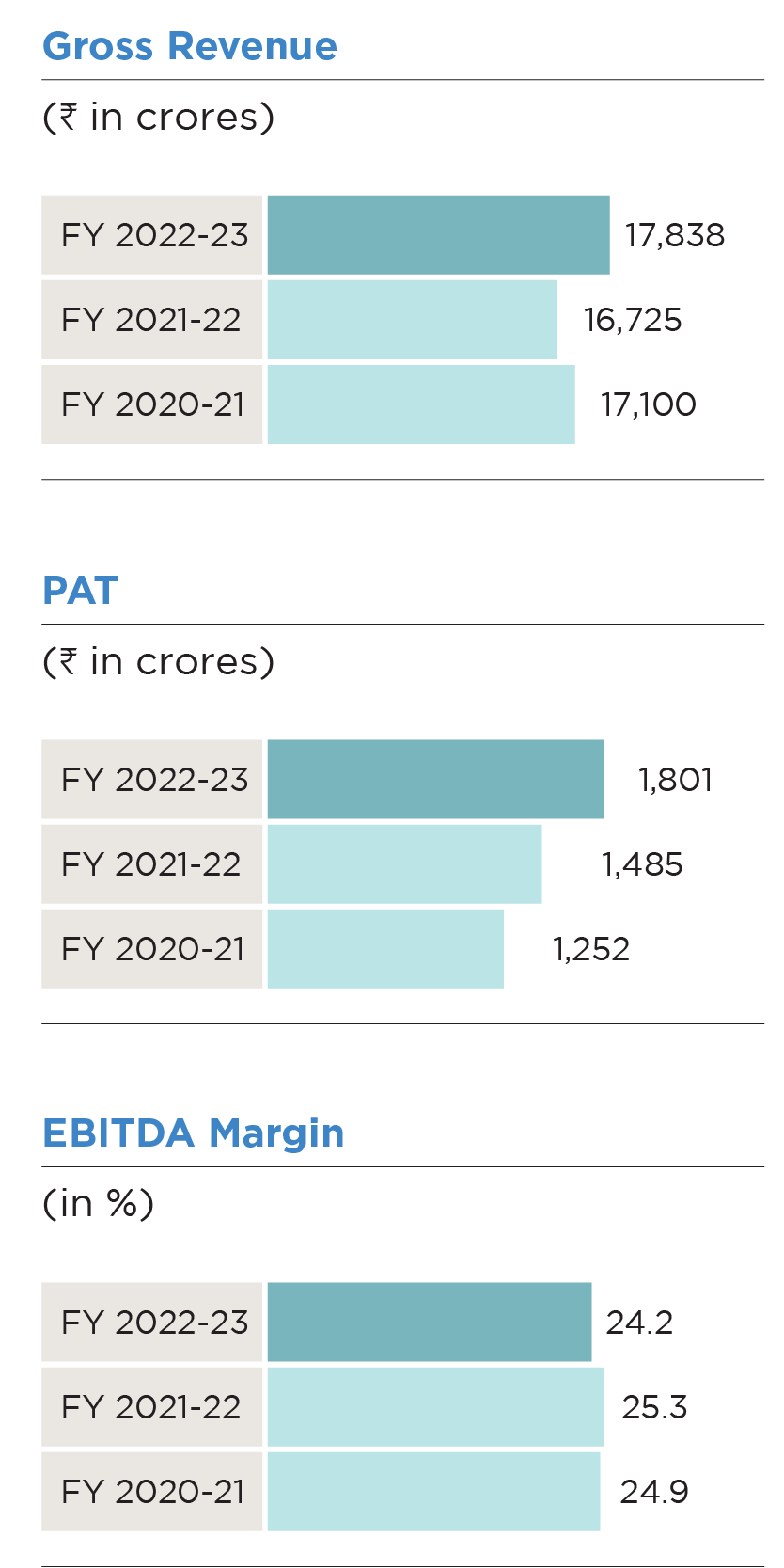

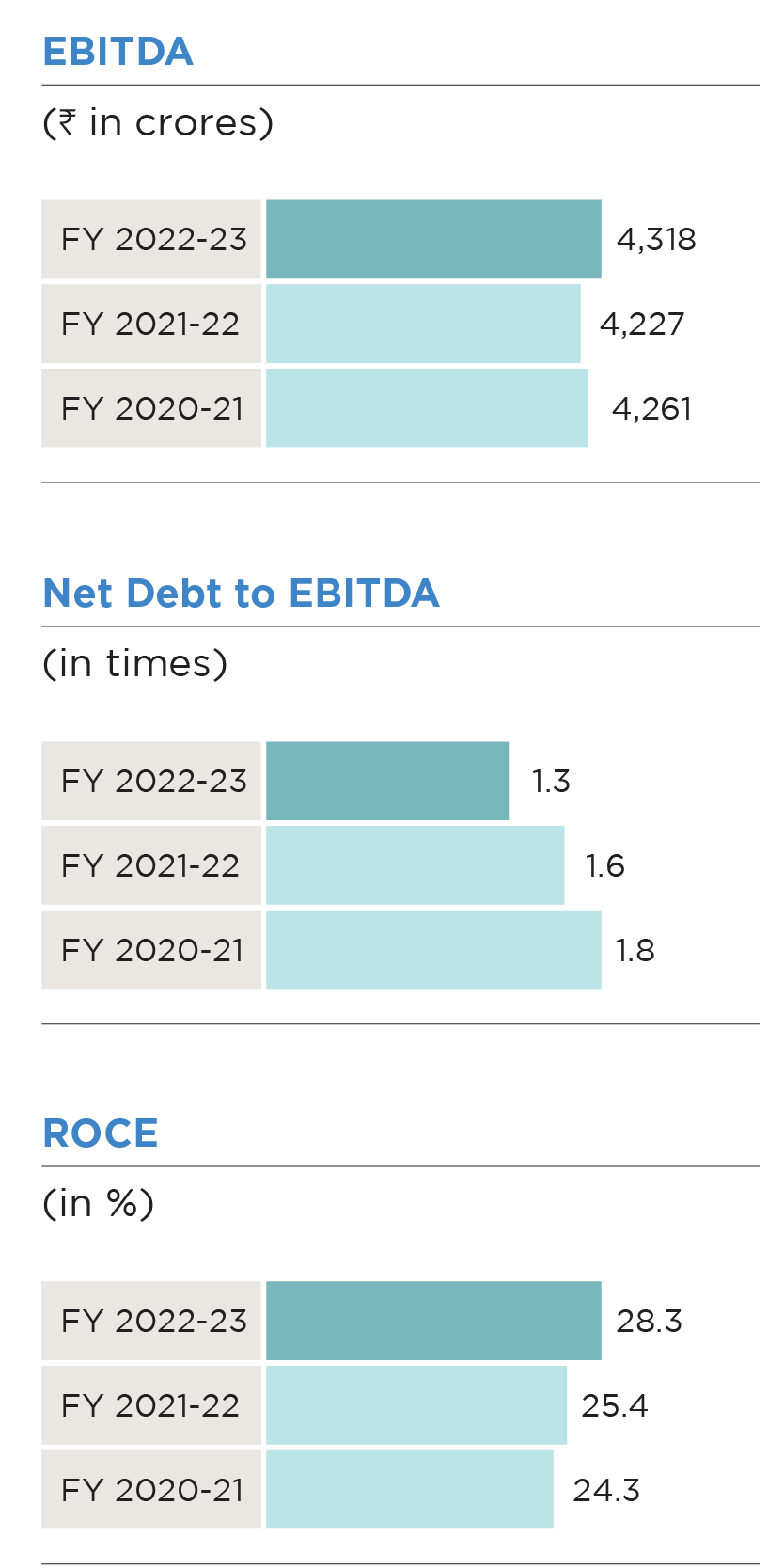

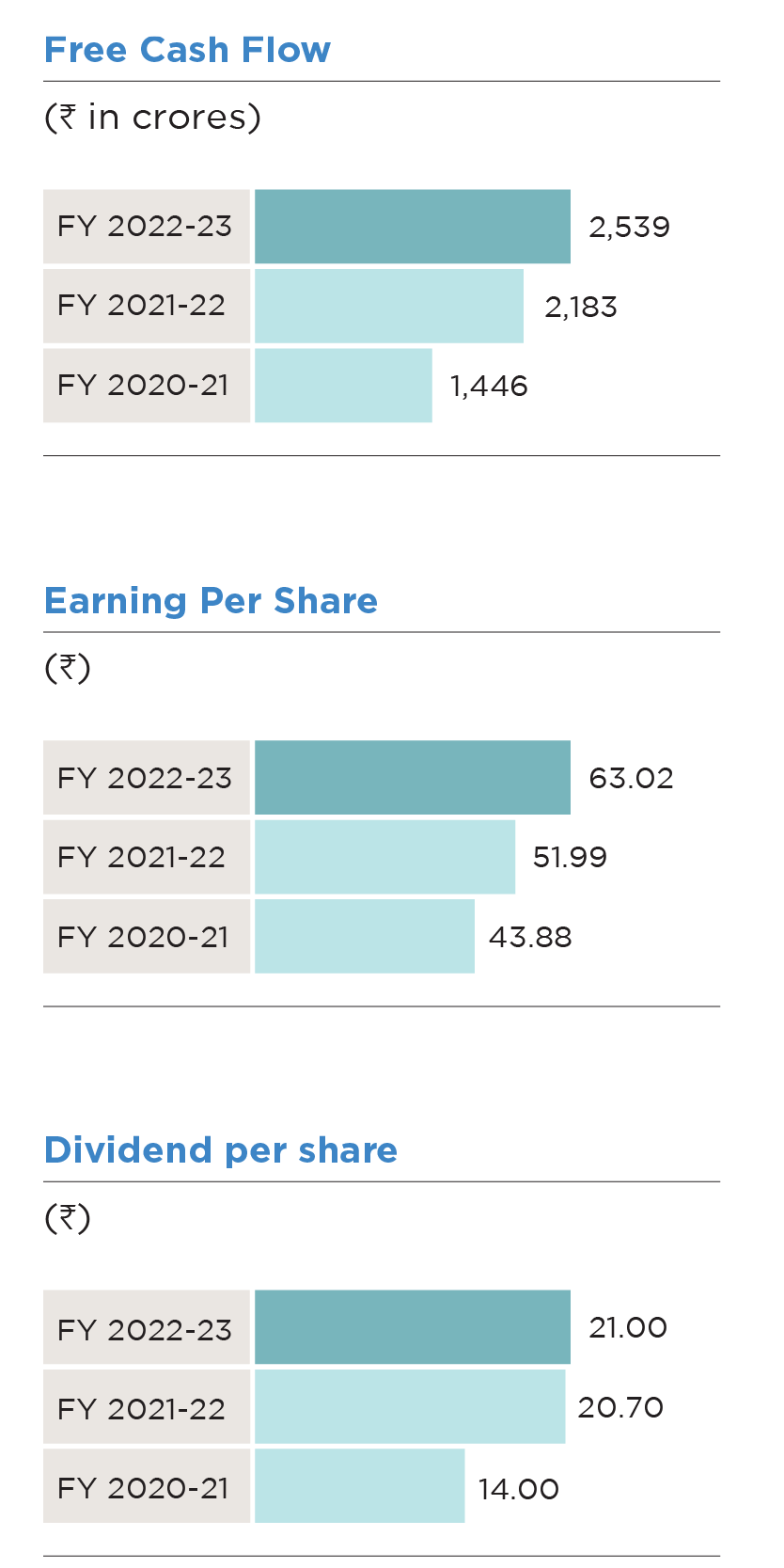

At Tata Communications, we maintained a Net Debt / EBITDA ratio of approximately 1.3x for FY 2022-23, in alignment with our objective of keeping it below 2x. This was achieved through a consistently strong profitability, a healthy balance sheet and robust cashflow generation.

We are very pleased with our accomplishments in turning around the Company over the last three years as reflected in our financial metrics. Our finance strategy is well poised to support the Company’s ambitious growth aspirations for the future.

Chief Financial Officer

Financial highlights

Risk management and treasury process controls

We adhere to Board-approved policies for forex and interest rate risk management, surplus cash investment, borrowings, banking guidelines and customer credit. These policies provide the framework for key decision-making in these matters. Additionally, strong process controls and a maker-checker system are in place for all treasury processes, which undergo periodic Internal Financial Controls testing and Internal Audits.

S4Hana TRM & IHC module implementation

All treasury transactions, including investments, borrowings, forex, bank guarantees / Letters of Credit, and intercompany loans, are recorded using the S4Hana Treasury & Risk Management and In-House Cash modules. The system automates Foreign Exchange exposure identification and streamlines the management of financial transactions.

Segment performance

Our data business has emerged as the primary catalyst for revenue growth, accounting for a significant portion of our revenue pie. This sector has consistently experienced double-digit year-onyear expansion, growth, over the last year, giving us the confidence that the business is progressing in the right direction and delivering superior customer experience.

80%

Income comes from data business

Our Digital Portfolio demonstrated robust growth across all its offerings, now comprising approximately 32% of data revenue. This growth is a testament to the strength and adaptability of the Digital Portfolio segment, and its ability to create significant value for stakeholders.

The Connected Solutions portfolio is experiencing rapid growth, fuelled by substantial investments in on-campus, private networks and off-campus offerings. The variety of opportunities present within the Connected Solutions sector underscores the potential for continued growth in the future.

In contrast, voice revenue continues to decline, in line with prevailing market conditions. This presents a unique opportunity to pivot our strategies towards more lucrative avenues, leading to longterm success and growth.

Strategies defining growth

At Tata Communications, we are dedicated to achieve sustainable, profitable growth, which is centred around two key pillars of our finance strategy.

Fit to Compete

Our Fit to Compete framework is centred around optimising our financial fitness through improved efficiencies and cost control. By building in stringent internal controls, we have been able to arrest revenue leakage and reduce costs. We have also improved our EBITDA to cash conversion by optimising working capital management and reducing our effective tax rate and interest costs.

Fit to Grow

Our Fit to Grow framework is aimed at achieving our ambition of profitable double-digit growth. This pillar focuses on getting our P&L and balance sheet ready to fund the next level of growth by investing in organic and inorganic expansion, improving our solution offerings through R&D, and expanding our footprint globally.

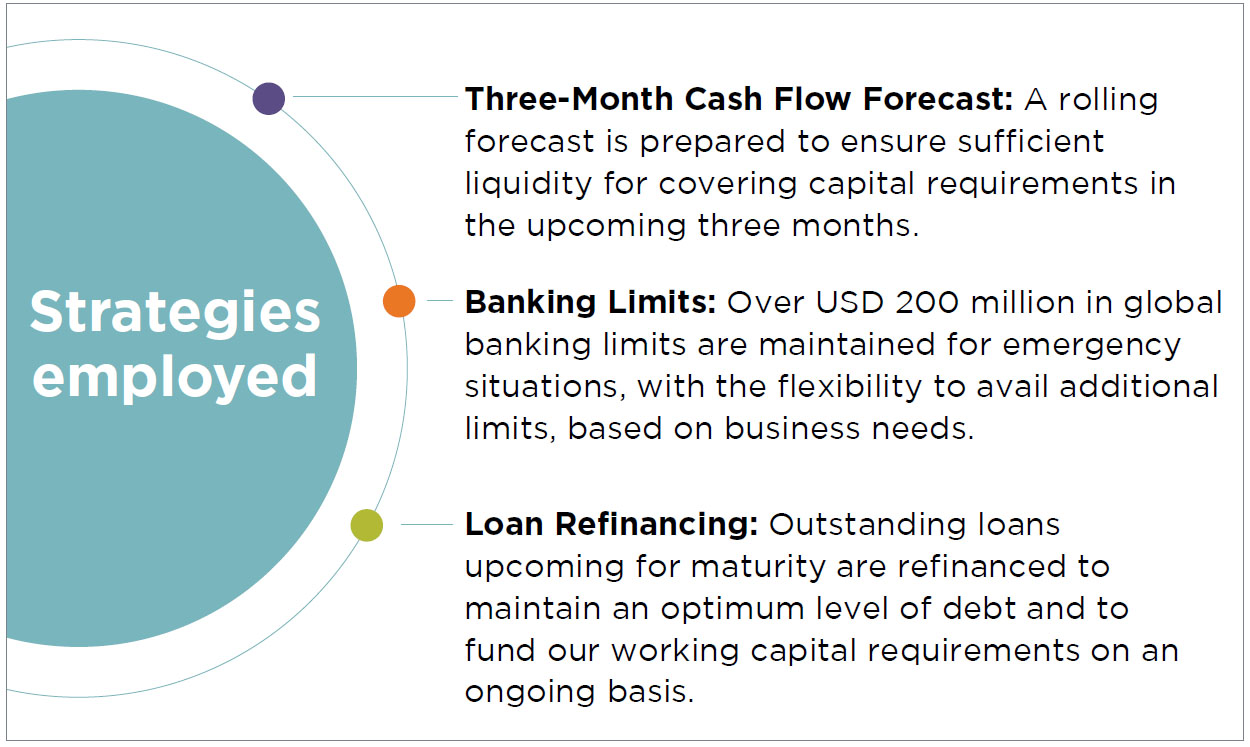

Tata Communications deploys the following strategies:

Some of our notable achievements include:

- Significant reduction in Provision for Doubtful Debts and Days Sales Outstanding

- Plugging revenue leakage in our product and service contract executions

- Reducing net debt, and improving our Effective Tax Rate.

These efforts have helped us move our portfolio from usage-based service to a fixed revenue model, providing us with predictability and stability.

We are investing in building for the future needs of our customers, and our cash position and profitability metrics give us the confidence to pursue the next wave of growth. By deepening our customer engagements and investing in core infrastructure and digital capabilities, we are making strategic shifts from 'Products to Platforms’ as part of our Reimagine strategy.

Strengthening relationships

Our commitment to sustainable growth is evidenced by our constant pursuit of new avenues for expansion, whether through strategic partnerships or bolt-on acquisitions that enhance our product offerings and global presence. We leverage our improved profitability and cash position to aggressively pursue these opportunities and communicate them transparently to internal and external stakeholders.

Capex: An investment for the future

As part of our growth strategy, we are investing in network transformation to enhance agility and programmability, and we anticipate low to mid single digit growth.

In line with our commitment to ongoing strategic investments, we are prioritising cable investments. We are also actively expanding our business opportunities through investments in incubation services, which complement our offerings and add value to our business.

USD 58.8 million

The Switch acquisition to complement MES Business Portfolio with live sports production capabilities

To tap into white space opportunities, we are investing in new offerings such as LoRa enabled, Cloud, Multi Cloud Connect, Media Native EDGE, SPAED, and Tata Communications MOVE™. Our Capital expenditure investments will help us expand customer penetration and improve our value proposition.

We recently acquired The Switch Enterprises LLC (‘The Switch’), a move that significantly enhances our Media and Entertainment Services (‘MES’) Business Portfolio through added capabilities in live sports production in North America.

Advancements in Next-Gen Connectivity and Collaboration Solutions

We have been making strides in Next-Generation Connectivity Solutions with the recent launch of IZO™ WAN and IZO™ SD-WAN. These cloud-based solutions simplify network management for enterprise customers, contributing to the growth of our Digital Portfolio.

Moreover, we have added several new offerings, including Tata Communications GlobalRapide, InstaCCTM and Tata Communications DIGO to our Collaboration portfolio to provide additional value and enhance our services.